interest tax shield calculator

First determine the total depreciation amount. 02022022 By Carol Daniel Legal advice.

Interest Tax Shield Formula And Excel Calculator

Interest Tax Shield Calculator.

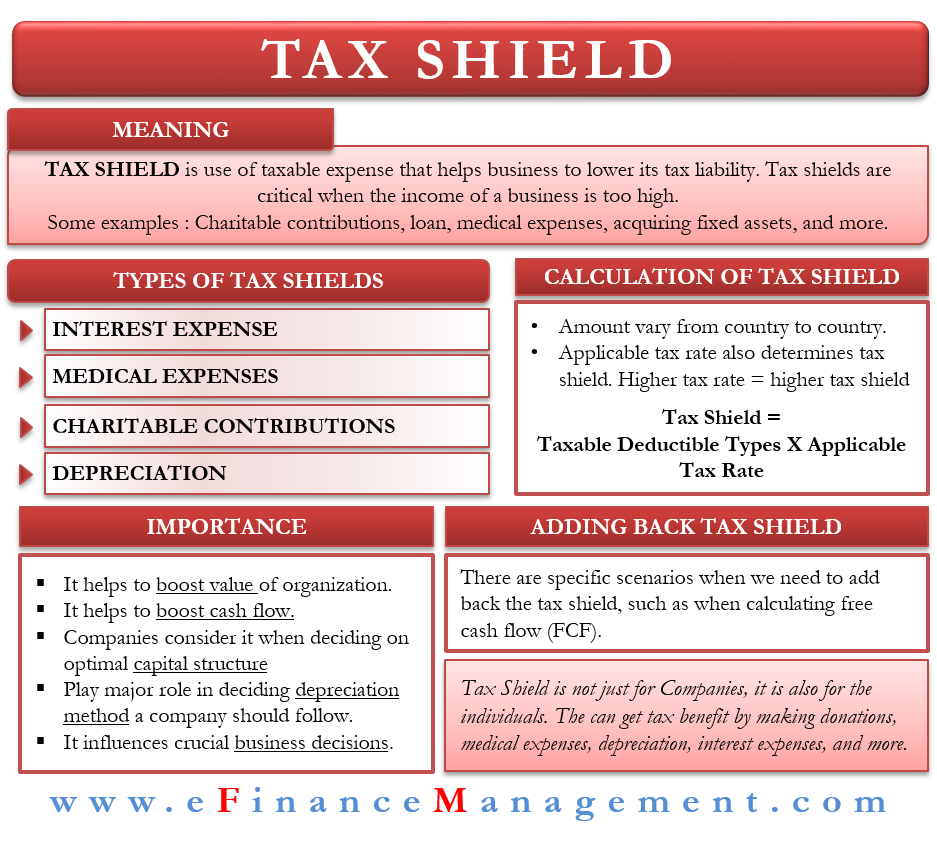

. It is possible to calculate the value of a tax shelter by multiplying the entire amount of taxable interest expenditure by the applicable tax rate. Tax shield is a reduction of taxable income due to decreasing it by deductible expenses like interest amortization and depreciation. Interest Tax Shield Interest Expense Tax Rate.

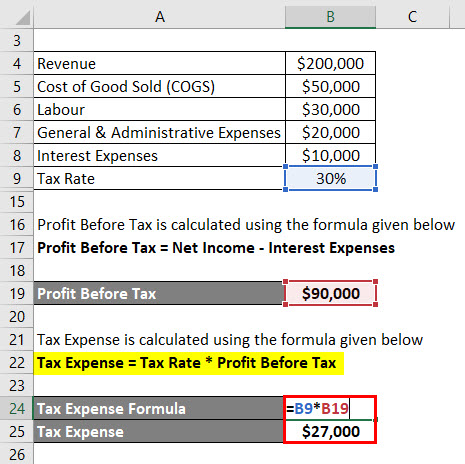

Ad TaxInterest is the standard that helps you calculate the correct amounts. Interest Tax Shield Example. This is equivalent to the 800000 interest expense multiplied by 35.

This step by step finance tool is used for calculating the interest tax shield. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution medical expenditure etc. If a corporations tax rate is 210 percent and the company incurs 1 million in.

This small business tool is used to derive the interest tax using the average debt tax rate and cost of debt. Tax_shield Deductible. Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. Adjusted Present Value APV Formula. This step by step finance tool is used for calculating the interest tax shield.

Using the formula above we find the. For this example we will assume its 10000000. Those deductions lower the income tax the company or individual has to pay in a given year.

Since the additional financing benefits are taken into account the primary benefit of the APV approach is that the economic benefits stemming from financing and tax-deductible interest expense payments eg. If you like Interest Tax Shield Calculator please consider adding a link to this tool by copypaste the following code. Else this figure would be less by 2400 800030 tax rate as only depreciation would.

Finally calculate the tax shield. Common expenses that are deductible include depreciation amortization mortgage payments and interest expense. In order to calculate the value of the interest tax shield you may use this interest tax shield calculator or calculate the value manually like we do in the following example.

If you wish to calculate tax shield value manually you should use the formula below. Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Thus Taxable Income declined from 1000 to 955.

A formula to calculate after-tax interest expense is interest expense 1 Tax. The formula used to calculate the adjusted present value APV consists of two. Tax is a cash expense and depreciation is a non-cash expense therefore it is a real-time value of money-saving.

For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. As such the shield is 8000000 x 10 x 35 280000. For example if a company has cash inflows of USD 20 million cash outflows of USD 12 million its net cash flows.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest Deduction As Mortgage Interest Mortgage interest deduction refers to the decrease in taxable income allowed to the homeowners for their interest on a home loan taken for purchase or construction of the house or any borrowings. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. This entry was posted in Blog News Articles and tagged calculate cpa tax depreciation paying tax services tax shield.

Lets understand this with the help of an example of a convertible bond. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. Interest Expense 20000.

A tax shield refers to deductions taxpayers. Next determine the applicable tax rate. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900.

Interest Tax Shield Interest Expense Tax Rate. Interest Tax Shield is defined as follows. The interest tax shield are broken out.

So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing arrangement. After-tax benefit or cash inflow calculator. The impact of adding removing a tax shield is highly impacted by the companys optimal capital structure which is a mix of debt and equity fundingMoreover the interest expense on the debt is tax deductible which makes the.

Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Interest Tax Shield Formula And Excel Calculator Relevance and Uses of Accrued Interest Formula. How to calculate the tax shield.

Basically the company uses two main tax shield strategies. The value of these shields depends on the effective tax rate for the corporation or individual. The term tax multiplier refers to the multiple which is the measure of the change witnessed in the Gross Domestic Product GDP of an economy due to change in taxes introduced by its government.

In this scenario the loan sourced from investors must be repaid in a given number of years. Interest Tax Shield Definition The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. In the fixed debt scenario the projects debt ratio changes but the total debt remains constant.

The Interest Tax Shield is the same as the Depreciation Tax Shield in concept. In such a case the tax shield is computed as follows. Interest Tax Shield Calculator.

It is neither received nor paid. For individuals Tax rate is primarily used for interest expense and depreciation expense in the case of a company. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

If the investor still pays 1000 of his initial equity capital in. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. For this example we will say the tax rate is 21.

Interest Tax Shield Calculator. Tax rate 35. The Interest Tax Shield is the same as the Depreciation Tax Shield in concept.

Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a tax rate of 15. And this net effect is the loss of the tax shield value but again of the original expense as income. Tax_shield Interest Expense Tax_rate 20000 35 7000.

Tax Shield 45. Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. Interest Tax Shield Calculator.

In such a case one needs to add back the after-tax interest expense to the income. The formula for tax shields is very simple and it is calculated by first adding the different tax-deductible expenses and then. The tax rate for the company is 30.

Net present value calculator. Determine the total depreciation value that can be considered in the deduction. Simpleaccounting rate of return ARR calculator.

The loan remains fixed and the repayment terms are indicated to the firm. In contrast though with the Interest Tax Shield it is Interest Expense that shields a Company from taxes paid. Formula to Calculate Tax Shield Depreciation Interest The term Tax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government.

Depreciation tax shield calculator. Tax Shield 30015. Future value of an annuity calculator.

Net present value calculator.

Tomorrows Planning Is Todays Tax Saving Invest Save Tax Earn Interest With Synd Taxshield Deposit Syndicatebank Deposit Award Winner Linkedin Photo

Net Operating Profit After Tax Nopat Formula And Excel Calculator

Income Tax Calculator Estimate Your Refund In Seconds For Free

Tax Shield Formula Step By Step Calculation With Examples

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Electric Calculator Design Element Free Image By Rawpixel Com Teddy Rawpixel Calculator Design Free Design Resources Design Element

Nopat Formula How To Calculate Nopat Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Calculator Efinancemanagement

Calculate Present Value Of Interest Tax Shield 16 3 Youtube

Taxes Icon Business Calculator Ticket Payment Taxes Commerce And Shopping Business And Finance Tax Law And Justice Icon Tax

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

Interest Tax Shield Formula And Excel Calculator